Correcting Overpayment Of Wages Minnesota . payroll services has responsibility for the following steps in this process: (1) medical expenses due or payable; the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. The law allows us to. You are covered by a union collective bargaining agreement that. To promptly collect payroll overpayments and to account for the repayments accurately. your employer may deduct money from your wages if: if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. an employer or insurer may not offset an overpayment of benefits against:

from www.templateroller.com

your employer may deduct money from your wages if: To promptly collect payroll overpayments and to account for the repayments accurately. if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. an employer or insurer may not offset an overpayment of benefits against: the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. You are covered by a union collective bargaining agreement that. payroll services has responsibility for the following steps in this process: The law allows us to. (1) medical expenses due or payable;

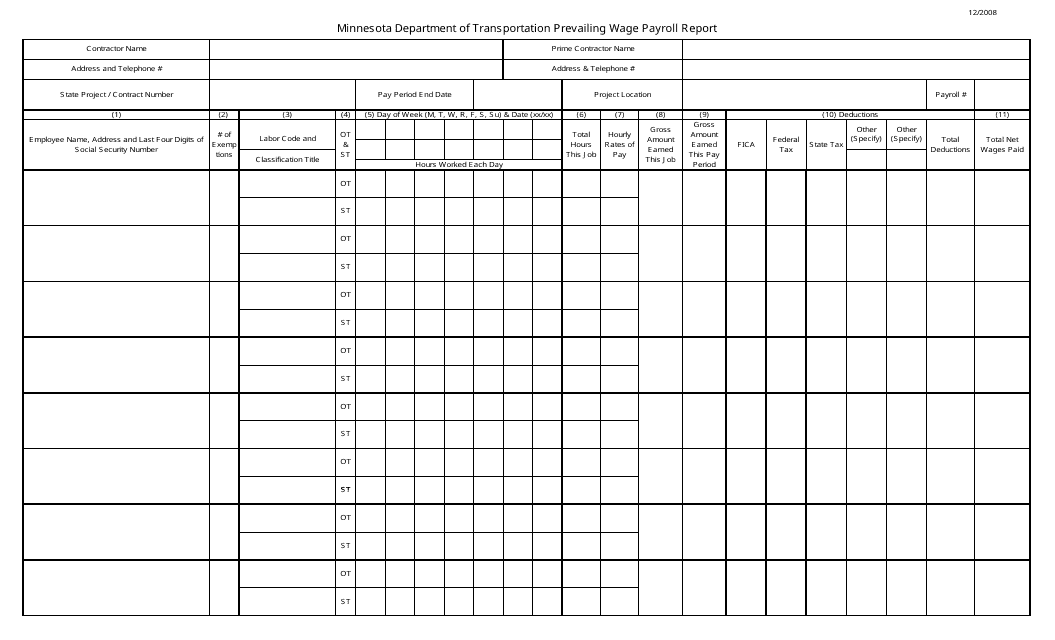

Minnesota Prevailing Wage Payroll Report Fill Out, Sign Online and

Correcting Overpayment Of Wages Minnesota if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. your employer may deduct money from your wages if: The law allows us to. if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. To promptly collect payroll overpayments and to account for the repayments accurately. (1) medical expenses due or payable; payroll services has responsibility for the following steps in this process: the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. an employer or insurer may not offset an overpayment of benefits against: You are covered by a union collective bargaining agreement that.

From www.patriotsoftware.com

How to Correct a Payroll Overpayment Steps and More Correcting Overpayment Of Wages Minnesota the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. To promptly collect payroll overpayments and to account for the repayments accurately. your employer may deduct money from your wages if: if your employer is not paying the minimum wage or overtime, you can file a claim. Correcting Overpayment Of Wages Minnesota.

From www.bemidjipioneer.com

Minimum wage set to increase 2.5 as labor shortages continue Correcting Overpayment Of Wages Minnesota The law allows us to. payroll services has responsibility for the following steps in this process: an employer or insurer may not offset an overpayment of benefits against: your employer may deduct money from your wages if: the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a. Correcting Overpayment Of Wages Minnesota.

From www.templateroller.com

Minnesota Prevailing Wage Payroll Report Fill Out, Sign Online and Correcting Overpayment Of Wages Minnesota the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. To promptly collect payroll overpayments and to account for the repayments accurately. You are covered. Correcting Overpayment Of Wages Minnesota.

From handypdf.com

Certified Payroll Form Minnesota Department of Labor and Industry Correcting Overpayment Of Wages Minnesota The law allows us to. an employer or insurer may not offset an overpayment of benefits against: your employer may deduct money from your wages if: To promptly collect payroll overpayments and to account for the repayments accurately. the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a. Correcting Overpayment Of Wages Minnesota.

From www.cbsnews.com

Minn. Chamber Of Commerce Sues Mpls. Over Minimum Wage Hike CBS Minnesota Correcting Overpayment Of Wages Minnesota if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. your employer may deduct money from your wages if: payroll services has responsibility for the following steps in this process: the minnesota department of revenue may issue a levy to collect part of. Correcting Overpayment Of Wages Minnesota.

From support.payhero.co.nz

Time Credits & Correcting Overpayments PayHero Support Centre Correcting Overpayment Of Wages Minnesota your employer may deduct money from your wages if: To promptly collect payroll overpayments and to account for the repayments accurately. You are covered by a union collective bargaining agreement that. The law allows us to. (1) medical expenses due or payable; payroll services has responsibility for the following steps in this process: the minnesota department of. Correcting Overpayment Of Wages Minnesota.

From lptv.org

Minnesota Minimum Wage to Increase in 2023 Lakeland PBS Correcting Overpayment Of Wages Minnesota an employer or insurer may not offset an overpayment of benefits against: if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. (1) medical expenses due or payable; the minnesota department of revenue may issue a levy to collect part of an employee's wages. Correcting Overpayment Of Wages Minnesota.

From grcready.com

Template Letter for Overpayment of Wages to Employee (Multiple Correcting Overpayment Of Wages Minnesota To promptly collect payroll overpayments and to account for the repayments accurately. if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. You are covered by a union collective bargaining agreement that. the minnesota department of revenue may issue a levy to collect part of. Correcting Overpayment Of Wages Minnesota.

From loans-detail.blogspot.com

What Is The Journal Entry For Payment Of Salaries Info Loans Correcting Overpayment Of Wages Minnesota your employer may deduct money from your wages if: The law allows us to. To promptly collect payroll overpayments and to account for the repayments accurately. an employer or insurer may not offset an overpayment of benefits against: the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a. Correcting Overpayment Of Wages Minnesota.

From www.youtube.com

Minnesota to Implement New Minimum Wage Rates in the New Year YouTube Correcting Overpayment Of Wages Minnesota payroll services has responsibility for the following steps in this process: You are covered by a union collective bargaining agreement that. if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. your employer may deduct money from your wages if: The law allows us. Correcting Overpayment Of Wages Minnesota.

From ar.inspiredpencil.com

Minnesota Minimum Wage Chart Correcting Overpayment Of Wages Minnesota your employer may deduct money from your wages if: the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. You are covered by a. Correcting Overpayment Of Wages Minnesota.

From mn.gov

Wages and Inflation in Minnesota / Minnesota Department of Employment Correcting Overpayment Of Wages Minnesota an employer or insurer may not offset an overpayment of benefits against: The law allows us to. the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. To promptly collect payroll overpayments and to account for the repayments accurately. if your employer is not paying the minimum. Correcting Overpayment Of Wages Minnesota.

From www.slideteam.net

Ways Correct Overpayment Wages Ppt Powerpoint Presentation Model Correcting Overpayment Of Wages Minnesota (1) medical expenses due or payable; an employer or insurer may not offset an overpayment of benefits against: The law allows us to. your employer may deduct money from your wages if: the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. To promptly collect payroll overpayments. Correcting Overpayment Of Wages Minnesota.

From www.youtube.com

Correcting Salary Overpayments YouTube Correcting Overpayment Of Wages Minnesota (1) medical expenses due or payable; an employer or insurer may not offset an overpayment of benefits against: You are covered by a union collective bargaining agreement that. if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. To promptly collect payroll overpayments and to. Correcting Overpayment Of Wages Minnesota.

From legaltemplates.net

Free Unpaid Wages Demand Letter Template PDF & Word Correcting Overpayment Of Wages Minnesota if your employer is not paying the minimum wage or overtime, you can file a claim with the department of labor and industry,. the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. your employer may deduct money from your wages if: (1) medical expenses due or. Correcting Overpayment Of Wages Minnesota.

From support.payhero.co.nz

Time Credits & Correcting Overpayments PayHero Support Centre Correcting Overpayment Of Wages Minnesota To promptly collect payroll overpayments and to account for the repayments accurately. the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. The law allows us to. (1) medical expenses due or payable; your employer may deduct money from your wages if: You are covered by a union. Correcting Overpayment Of Wages Minnesota.

From support.payhero.co.nz

Time Credits & Correcting Overpayments PayHero Support Centre Correcting Overpayment Of Wages Minnesota an employer or insurer may not offset an overpayment of benefits against: (1) medical expenses due or payable; your employer may deduct money from your wages if: payroll services has responsibility for the following steps in this process: The law allows us to. You are covered by a union collective bargaining agreement that. To promptly collect payroll. Correcting Overpayment Of Wages Minnesota.

From www.laborposters.org

Free Minnesota Minnesota Minimum Wage Labor Law Poster 2021 Correcting Overpayment Of Wages Minnesota (1) medical expenses due or payable; To promptly collect payroll overpayments and to account for the repayments accurately. the minnesota department of revenue may issue a levy to collect part of an employee's wages to pay a debt. your employer may deduct money from your wages if: if your employer is not paying the minimum wage or. Correcting Overpayment Of Wages Minnesota.